Apenzar Financial Modeling

Test Your Assumptions.

Make Better Decisions.

Grow Your Business.

We've relied on financial modeling for years to predict growth, adjust to change and make smart decisions about our consulting business.

Now we're offering this premium service to our clients.

It's your turn to reap the benefits of financial modeling for your business.

What Is

Financial Modeling?

Financial modeling is a tool that takes all of the possible factors that affect your business, figures out how they affect each other, and calculates your bottom-line profits based on those inputs.

Basically, it's a mathematical crystal ball that helps you see into the future.

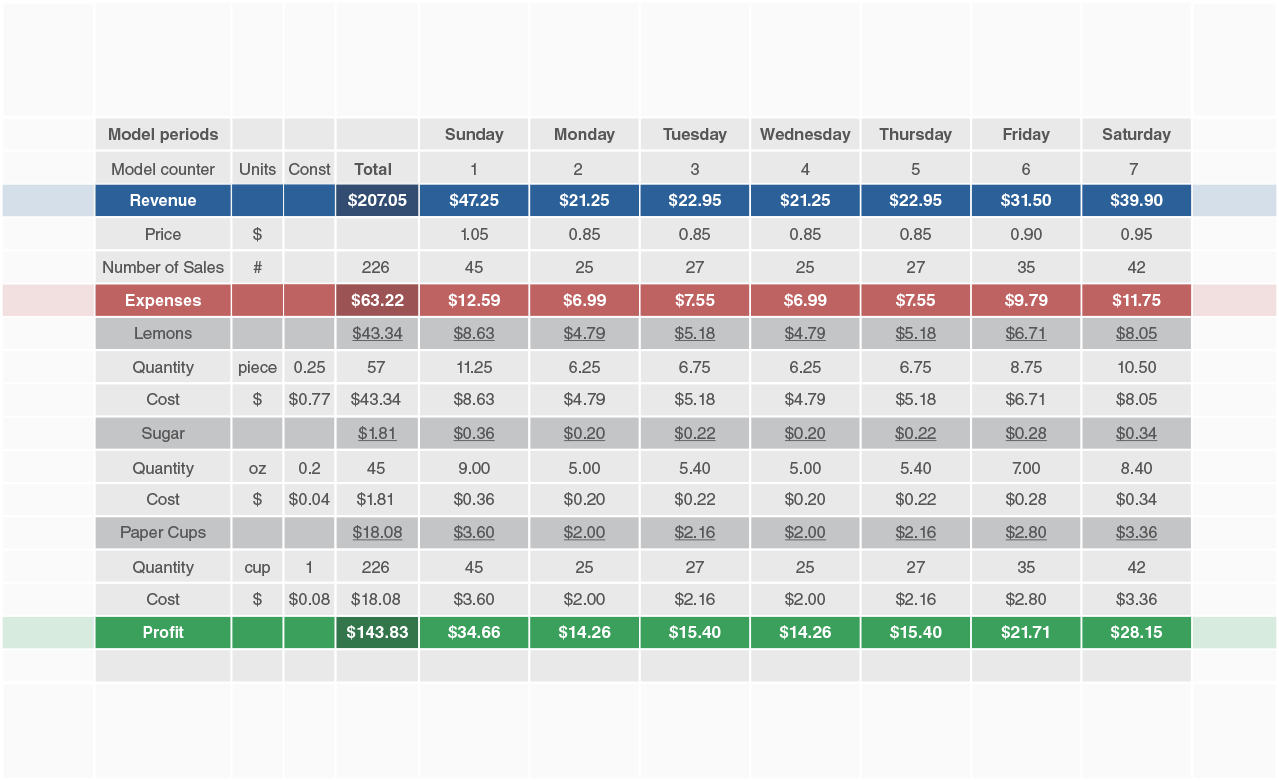

To understand how it works, consider a child's lemonade stand. The most basic inputs are the cost of lemons, sugar, and paper cups, plus the price charged per sale and the number of sales you expect to make each day.

Lemonade Stand Business

Imagine the Possibilities

Think that financial modeling is just for giant corporations? Think again! With a customized model at your fingertips, you can:

- Test your assumptions

- Verify key drivers of your business

- Compare and contrast business choices

- Fine-tune pricing, delivery options and discounts

- Calculate the actual amount of capital you need to start up

- Understand which factors have the biggest impact on your bottom line

- Model out your revenue and growth

- Model out your expenses based on key conditions

- Be more prepared and confident with potential investors

Expert Modeling, Superior Results

A financial model is only as good as its assumptions. Our expert financial modeling goes beyond the basics of revenue and expense tracking to include important specifics like growth rates, operating margins — and how the relationships among these factors change over time.

Once we've determined all the factors that affect your business and how they are related to each other, we turn that information into a series of mathematical equations and algorithms.

When the math is done, we make sure that everything is presented to you in a clear, easy-to-read spreadsheet. This is your tool to use to make vital decision about your business, so it's designed to be user-friendly.

Super-Charge

Your Business

So many of the recurring tasks you face have an impact on your bottom line. Think about how often you interact with:

- Real vs. accrued cash flow monitoring

- Sales data modeling and analysis

- New product launches

- Pricing calculations

- SKU creation and inventory tracking

- Project progress and cost tracking

- Comparing and contrasting delivery options

When you take these processes into account in your financial model, you can build customized business tools that make it easy to automate and streamline your management tasks.

-

Save Time

by automating processes and creating instant reports

-

Save Effort

by monitoring processes and controlling for complexities

-

Save Money

by testing scenarios and making data-driven decisions

Learn More About Apenzar

Financial Modeling Today

Ready to take your growth to the next level? We'd love to know more about your

business and help you decide if financial modeling is right for you.